Ilu Women’s Empowerment Fund

Ilu Women’s Empowerment Fund

Advancing Gender Equality in Latin America and the Caribbean

Deetken Impact, an award-winning Canadian impact investing firm, launched the Ilu Women’s Empowerment Fund, the first gender lens investing fund that aims to empower women and drive climate resilience in Latin America and the Caribbean.

About the Ilu Women’s Empowerment Fund

The Ilu Women’s Empowerment Fund reflects a deep commitment to integrating gender equality into every aspect of investment strategy and business operations to drive meaningful progress toward economic, climate, and social equity across Latin America and the Caribbean. With USD $35 million in AUM, the Ilu Fund has invested in 32 companies in 13 countries, and has a record of delivering strong returns to investors.

We advance gender equality with every dollar invested. Deetken Impact partnered with Pro Mujer to design and implement a gender lens investing approach incorporating gender considerations and metrics at every step of the investment process to assess, monitor, and advance companies’ gender business practices while providing technical assistance to advance gender business practices

Our Investment Strategy

The Ilu Fund’s investment strategy places strong emphasis on women’s economic empowerment and entrepreneurship. Recognizing that climate change disproportionately impacts women, the Ilu Fund’s investment strategy prioritizes investments that also mitigate climate change and enhance climate resilience in vulnerable communities. Portfolio investments include financial institutions that provide integrated and thoughtfully designed services for low-income women, including access to healthcare, green credit products, educational loans, financial services, and technical assistance, as well as gender-smart investments in renewable energy, affordable housing and sustainable production.

Some of our recent milestones

The Ilu Women’s Empowerment Program

The Ilu Women’s Empowerment Program was developed to amplify the impact of the Fund’s capital while advancing gender equality in the region through a three-pronged approach of fundraising of blended finance capital, tailored technical assistance projects with portfolio companies, and knowledge dissemination and advocacy for gender lens investing in the region. Learn more here.

DFC Financing

The United States International Development Finance Corporation (formerly OPIC) committed $10 million of senior debt financing to the Ilu Fund. This investment will advance DFC’s 2X Women’s Initiative, which has catalyzed more than $1 billion in capital to empower women in developing countries around the world.

Gender Smart Investment Management

Deetken Impact and Pro Mujer are implementing gender smart practices across the Fund’s investment management and governance functions. Through a structured gender data collection process, we aim to identify areas of strength and opportunities for improvement in a company’s business practices, understand and shape gender-smart business objectives, and monitor progress over time. This process also informs our investment decisions.

Million Invested

Portfolio Companies

Private Sector Investors

%

Investors Are Women

Why Latin America and the Caribbean?

Why Latin America and the Caribbean?

What Does It Mean to Invest With a Gender Lens?

It means integrating gender-based factors into investment decisions.

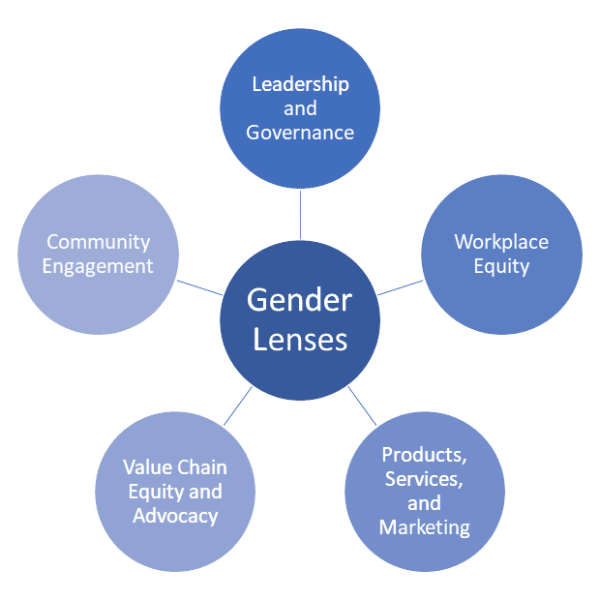

We look for businesses that show leadership or commitment to one or more of our five gender lenses.

Gender Smart at Every Step

Screening

Clear leadership or commitment to one or more of our five gender lenses

Due Diligence

Scoring against comprehensive gender smart criteria aligned with our five gender lenses

Investment

Established gender-smart objectives and CEO-level commitment to continuous progress on addressing gender gaps identified in due diligence

Monitoring and Reporting

Measurement and evaluation of gender metrics for reporting to stakeholders

Engagement

Tailored acceleration and engagement to advance gender business practices

Investment Management Team

José Lamyin

Managing Partner Investments & Strategy

Alexa Blain

Managing Partner Operations & Finance

Carl Black

Chief Investment Officer

José Lamyin

Managing Partner Investments & Strategy

Alexa Blain

Managing Partner Operations & Finance

Rachel Murphy

Senior Impact & Gender Officer

Alejandra Revueltas

Senior Portfolio Officer

Betsy Gaborit

Investment Officer

Laura Sanz

Investment Officer